Republicans Eye Social Program Cuts to Fund Tax Breaks for the Wealthy

More Tax Cuts for the Wealthy. More Cuts for 70 Million Americans.

- Extending Tax Cuts Adds: $4,000 billion to the national debt over the next decade.

- Proposed Cuts Save: $260 billion from social programs over the same period.

- Net Effect: Even with the proposed cuts, the national debt would increase by $3,740 billion ($3,74 Trillion) over the decade.

In a move that has sparked widespread concern, Republican leaders are reportedly considering significant cuts to social programs they once vowed to protect. The proposed changes aim to offset the enormous cost of extending the 2017 tax cuts, which largely benefited billionaires and large corporations.

President Donald Trump’s economic advisers and congressional Republicans have initiated discussions about making substantial alterations to Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and other federal safety net programs. These programs currently provide essential support to over 70 million low-income Americans.

The 2017 tax bill, a hallmark of Trump’s first term, lowered taxes for the vast majority of Americans but disproportionately favored the wealthy. With major portions of that law set to expire at the end of this year, extending these provisions could add more than $4 trillion to the national debt over the next decade, according to congressional analysts. The national debt already exceeds $36 trillion.

While Republican leaders support the extension of the tax cuts, there is growing concern within the party about the resulting increase in borrowing. To address this, some lawmakers are turning their attention to social safety net programs as potential areas for cost savings. Additionally, there is interest in repurposing funds allocated for clean energy initiatives.

To assess how cutting social programs and extending tax cuts would impact the national debt, we’ll break down the figures and calculate the percentages relative to the current national debt.

1. Cost of Extending Tax Cuts

- Amount: Extending President Trump’s 2017 tax cuts is projected to add more than $4 trillion to the national debt over the next decade.

2. Proposed Cuts to Social Programs

- Medicaid Work Requirements: Implementing a “responsible and reasonable work requirement” for Medicaid benefits could yield about $100 billion in savings over ten years.

- Increased Eligibility Checks: Checking Medicaid eligibility more than once per year could save an additional $160 billion over ten years.

- SNAP Adjustments: Specific savings from proposed SNAP changes aren’t quantified in the provided information, but for estimation purposes, let’s assume additional savings of $200 billion over ten years.

- **Total Estimated Savings from Cuts: Approximately $1 trillion over ten years.

3. Current National Debt

- Amount: The national debt currently exceeds $36 trillion.

4. Calculating Percentages

a. Tax Cuts Extension as a Percentage of National Debt

- Calculation: $4 trillion$36 trillion×100=11.1%\frac{\$4 \text{ trillion}}{\$36 \text{ trillion}} \times 100 = 11.1\%$36 trillion$4 trillion×100=11.1%

- Result: Extending the tax cuts would increase the national debt by approximately 11.1% over ten years.

b. Social Program Cuts as a Percentage of National Debt

- Calculation: $1 trillion$36 trillion×100=2.8%\frac{\$1 \text{ trillion}}{\$36 \text{ trillion}} \times 100 = 2.8\%$36 trillion$1 trillion×100=2.8%

- Result: Cutting social programs would reduce the national debt by approximately 2.8% over ten years.

5. Net Effect on the National Debt

- Net Increase: $4 trillion (tax cuts)−$1 trillion (program cuts)=$3 trillion\$4 \text{ trillion (tax cuts)} – \$1 \text{ trillion (program cuts)} = \$3 \text{ trillion}$4 trillion (tax cuts)−$1 trillion (program cuts)=$3 trillion

- Percentage of National Debt: $3 trillion$36 trillion×100=8.3%\frac{\$3 \text{ trillion}}{\$36 \text{ trillion}} \times 100 = 8.3\%$36 trillion$3 trillion×100=8.3%

- Result: The national debt would increase by a net 8.3% over ten years due to these combined actions.

6. Annual Impact

- Annual Cost of Tax Cuts: $4 trillion÷10 years=$400 billion per year\$4 \text{ trillion} \div 10 \text{ years} = \$400 \text{ billion per year}$4 trillion÷10 years=$400 billion per year

- Annual Savings from Program Cuts: $1 trillion÷10 years=$100 billion per year\$1 \text{ trillion} \div 10 \text{ years} = \$100 \text{ billion per year}$1 trillion÷10 years=$100 billion per year

- Net Annual Increase: $400 billion−$100 billion=$300 billion per year\$400 \text{ billion} – \$100 \text{ billion} = \$300 \text{ billion per year}$400 billion−$100 billion=$300 billion per year

7. Contextualizing the Impact

- Tax Cuts Benefit: The tax cuts primarily benefit wealthy individuals and large corporations.

- Social Program Cuts Affect: Reductions would impact over 70 million low-income Americans relying on Medicaid and SNAP.

- Debt Implications: Despite the savings from social program cuts, the extension of tax cuts results in a net increase in the national debt.

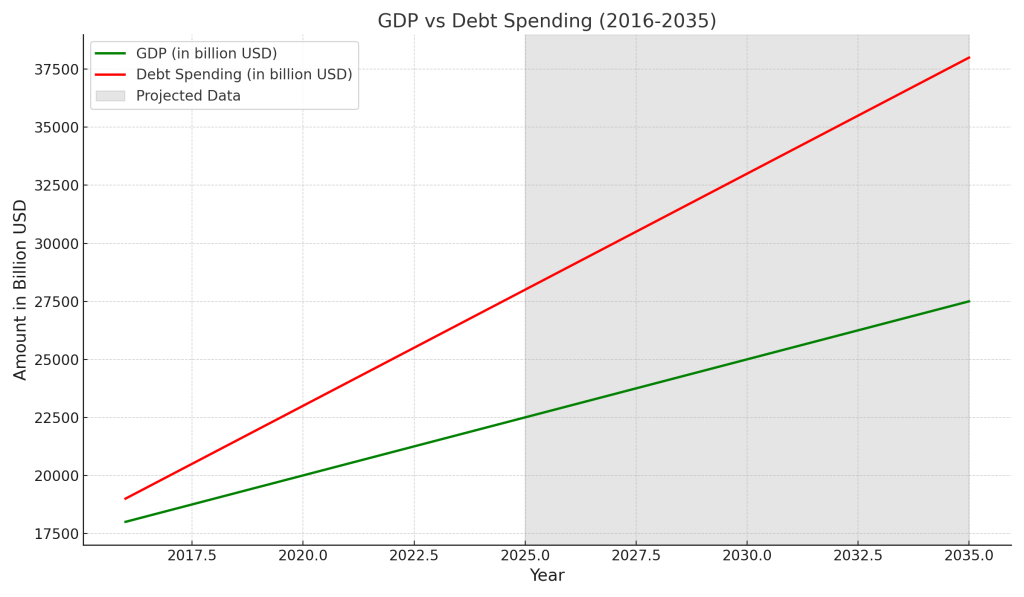

8. Visual Representation

- National Debt Before Changes: $36 trillion

- After Extending Tax Cuts: $36 trillion + $4 trillion = $40 trillion

- After Program Cuts: $40 trillion – $1 trillion = $39 trillion

- Overall Increase: $39 trillion – $36 trillion = $3 trillion net increase over ten years

9. Summary Table

| Item | Amount ($ trillion) | Percentage of National Debt |

|---|---|---|

| Cost of Extending Tax Cuts | 4 | 11.1% |

| Savings from Social Program Cuts | 1 | 2.8% |

| Net Increase in National Debt | 3 | 8.3% |

10. Considerations

- Economic Growth: These figures do not account for potential economic growth or recession, which could affect tax revenues and social program needs.

- Interest Rates: Changes in interest rates could increase the cost of servicing the national debt.

- Policy Changes: Future legislative actions could alter these projections.

If the proposed cuts to social programs are implemented, saving approximately 2.8% of the national debt over ten years, but tax cuts for the wealthy are extended, increasing the debt by 11.1%, the national debt would still grow by a net 8.3% over the next decade. This analysis highlights that the savings from social program cuts would only offset a fraction of the cost incurred by extending tax cuts primarily benefiting high-income individuals and large corporations.

Observations

- Magnitude Difference: The cost of extending the tax cuts ($4,000 billion) is significantly larger than the combined savings from proposed social program cuts ($260 billion).

- Percentage Comparison: The proposed cuts to social programs amount to only 6.5% of the cost of extending the tax cuts.

Detailed Breakdown

| Item | Amount ($ billions) | Percentage of Tax Cut Cost |

|---|---|---|

| Cost of Extending Tax Cuts | 4,000 | 100% |

| Proposed Social Program Cuts | ||

| – Medicaid Work Requirements Savings | 100 | 2.5% |

| – Increased Eligibility Checks Savings | 160 | 4% |

| Total Social Program Cuts | 260 | 6.5% |

| Net Increase in National Debt | 3,740 | 93.5% |

Targeting Medicaid and SNAP

Medicaid, which provides health benefits to over 70 million Americans, is one of the primary programs under scrutiny. Republicans argue that Medicaid spending has ballooned since the Affordable Care Act’s expansion and that the program’s structure exerts undue pressure on the federal budget. House Budget Committee Chair Jodey Arrington (R-Texas) has proposed implementing “responsible and reasonable work requirements” for Medicaid benefits, similar to those already in place for SNAP. Arrington suggests that such measures could yield about $100 billion in savings, with an additional $160 billion saved by increasing the frequency of Medicaid eligibility checks.

Conservative think tanks like the Paragon Health Institute have published papers advocating for Medicaid changes that could reduce federal deficits by more than $50 billion annually. These proposals often include tightening eligibility requirements and reducing federal matching payments to states.

SNAP, commonly known as the food stamp program, is also in the crosshairs. Republicans are discussing reversing provisions from the 2017 farm bill that allowed for increased benefits, even if it meant raising the national debt. There is also momentum to broaden work requirements for SNAP eligibility, a recommendation found in the Heritage Foundation’s Project 2025 playbook.

Promises Reversed

These developments mark a significant shift from previous Republican assurances that social programs like Medicaid and SNAP would remain untouched. Critics argue that cutting these programs breaks promises made to vulnerable Americans who rely on them for basic needs like healthcare and food security.

“Some of them are looking at Medicaid and food stamps. When you talk about spending, that is the place they immediately go,” said a GOP policy adviser who spoke on condition of anonymity. “But I’m not sure they want the headlines about paying for tax cuts by cutting those programs.”

The last time Republicans controlled both branches of Congress and the White House, efforts to repeal the Affordable Care Act—and by extension, reduce Medicaid spending—were met with significant backlash, even in GOP-controlled states. One Senate plan in 2017 would have lowered Medicaid enrollment by 15 million people, leaving most without alternative health coverage.

Impact on Low-Income Americans

Should these proposed cuts become reality, the impact on low-income Americans could be devastating. Medicaid and SNAP are lifelines for millions, providing access to healthcare services and essential nutrition. Reductions in these programs could exacerbate poverty levels and widen the socioeconomic gap.

Economists warn that cutting social programs to fund tax breaks for the wealthy could have long-term negative effects on the economy. Increased poverty and reduced consumer spending among low-income populations could stifle economic growth, offsetting any short-term gains from the tax cuts.

Public Response and Outlook

Public reaction has been swift and largely negative. Advocacy groups and some policymakers are calling for the protection of social safety nets, emphasizing the moral and economic implications of cutting aid to the most vulnerable.

As the debate continues, the Republican Party faces a critical decision that could define its economic and social policy for years to come. Balancing fiscal responsibility with the needs of millions of Americans is no small task, and the choices made in the coming months will have lasting consequences.

The proposition to cut social programs to fund tax extensions for the wealthy highlights a stark policy contrast and raises questions about national priorities. As lawmakers deliberate, the nation watches closely, aware that the outcomes will significantly affect both the economy and the lives of millions who depend on these essential services.